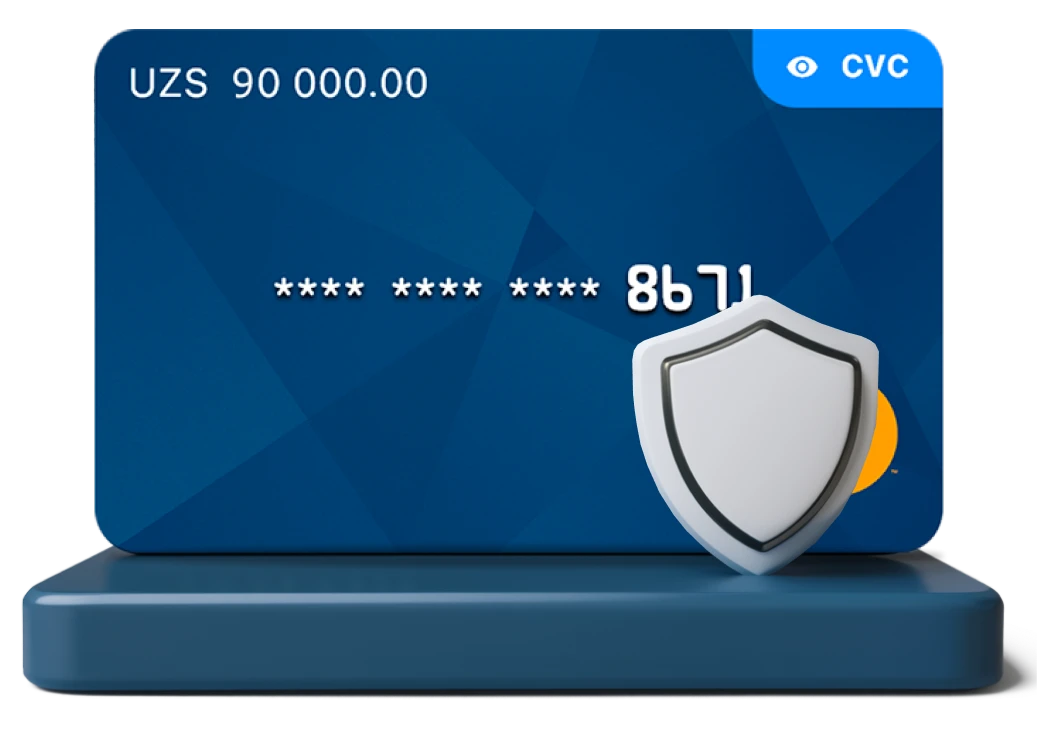

Mastercard Standart Virtual

International virtual card Mastercard Standart Virtual from Octobank

Card issue

No commission charged

Minimum balance

0.25 USD

Currency

USD / UZS

Card service

No commission charged

Mastercard Standart Virtual

Advantages of the card

Get freedom of action and many additional advantages of the Mastercard payment system. By becoming a premium card holder you get the opportunity to receive discounts when making payments abroad and use additional services

Top up your card account

When conducting conversion transactions in cash, no commission is charged

Operations with cash

When processing transactions to receive cash made with an Octobank JSC card at the Octobank JSC cash desks, no commission is charged

Remote service

When providing remote service services (SMS notification and protection of purchases via the Internet 3D Secure), no commission is charged

How to open a card

Register in Octo-Mobile

Choose and order a card

Make a deposit

Your card is ready

Information on the Mastercard Standard Virtual card:

Mastercard Standard Virtual is a virtual card that can be used for online purchases, hotel bookings, payment for services and much more. It is ideal for those who prefer cashless transactions and digital solutions.

One of the most attractive aspects of the Mastercard Standard Virtual card is that it is offered without any issuance or maintenance fees. Issuing and servicing a card costs you 0 UZS!

The Mastercard Standard Virtual card works in two currencies: USD and UZS, making it an ideal choice for those making international purchases in Uzbekistan or traveling abroad.

It is important to note that the Mastercard Standard Virtual card must have a minimum balance of only 0.25 USD. This ensures that you always have access to your funds when you need it.

The Mastercard Standard Virtual card is your key to the world of digital finance. Order your Mastercard Standard Virtual card today and start enjoying all its benefits!

Get a consultation on card issuance

Do you have any questions? We may have already answered

Is it possible to withdraw funds before the end of the deposit period?

It depends on the terms of the deposit. Some deposits allow early withdrawal with loss of interest, others do not.

What are the advantages of foreign currency deposits?

Key benefits include protection from local currency inflation, the ability to earn income in a stable currency and diversification of the investment portfolio.

Can I top up my foreign currency deposit?

Yes, many banks offer deposits with the possibility of replenishment, but the conditions may vary, so it is important to familiarize yourself with the agreement.

What is a foreign currency deposit?

A foreign exchange deposit is a bank deposit placed in a foreign currency, allowing investors to earn interest on their funds by keeping them in a stable currency.

Still have questions? Contact us!

Your personal assistant for all questions in the bank! He will help you understand the services and answer any questions