Tariffs for private clients

Commission fees for banking services to individuals, issuance of corporate cards and the provision of terminal equipment to trade and service enterprises.

tarify_na_obsluzhivanie_fizicheskih_lic_s_17_iyunya_2024_goda.pdf, 2.71 MB

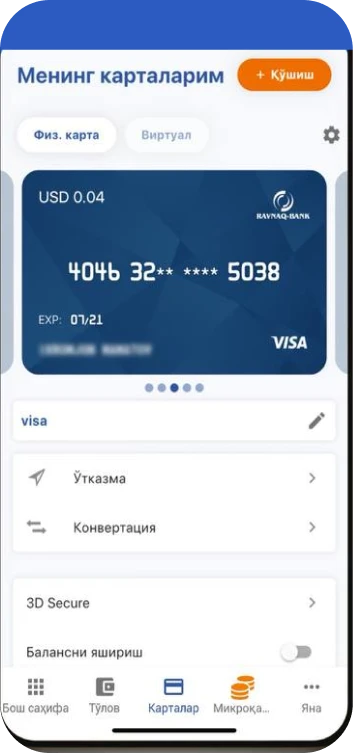

Public offer for the provision of payment services via the Octo-Mobile mobile application

publichnaya_oferta_o_vypuske_i_obsluzhivanii_bankovskih_kart_fizicheskogo_lica_v_yavochnom_poryadke_ili_putyom_distancionnogo_obsluzhivaniya.pdf, 3.35 MB

Public offer for the issuance and servicing of bank cards either in-person or via remote service

publichnaya-oferta-2024.pdf, 1.10 MB

Do you have any questions? We may have already answered

Is it possible to withdraw funds before the end of the deposit period?

It depends on the terms of the deposit. Some deposits allow early withdrawal with loss of interest, others do not.

What are the advantages of foreign currency deposits?

Key benefits include protection from local currency inflation, the ability to earn income in a stable currency and diversification of the investment portfolio.

Can I top up my foreign currency deposit?

Yes, many banks offer deposits with the possibility of replenishment, but the conditions may vary, so it is important to familiarize yourself with the agreement.

What is a foreign currency deposit?

A foreign exchange deposit is a bank deposit placed in a foreign currency, allowing investors to earn interest on their funds by keeping them in a stable currency.

Still have questions? Contact us!

Your personal assistant for all questions in the bank! He will help you understand the services and answer any questions.